No annual fee, competitive rates — that’s just the start of all perks our Visa® credit cards bring to how you spend.

Key Features

-

![]() Competitive Rates

Competitive Rates

-

![]() No Annual Fee

No Annual Fee

-

![]() Shop anywhere Visa is accepted

Shop anywhere Visa is accepted

- Auto Enroll

- 1 point per $1 spent1

- Redemption Options:

- Gift Cards

- Online Catalog

- Cash Back ($1 per 100 points)

- Competitive rates and boosted purchasing power

- Shop anywhere Visa® is accepted, online or offline

- Enjoy an introductory 0% APR†; rates as low as 14.50% APR* based on credit history

- No annual fee

- Added peace of mind with $1,000,000 Travel Accident Insurance, Travel & Emergency Assistance, Warranty Manager Service, Auto Rental Insurance

- Enjoy concierge services, like limousine “meet & great”, special event seating, and more

- Includes EMV chip technology for boosted security

- Know where your money is going with Visa Purchase Alerts

- Quickly replace your card if lost or stolen

- 24/7 cardmember service, 365 days a year

Register For Credit Card Rewards

Traveling?

Set a travel notice by calling us at 1-301-944-1800 or 1-800-956-2328 at least 1 business day in advance of your trip and provide: last 4 digits of card number(s), the dates of your trip and your destination.

Points Expire 3 years | Minimum points to redeem 2,5001

Control the cards in your wallet with the phone in your pocket. Get the free mobile app that lets you control your card usage on the go — save time and gain peace of mind with CardManager.

- Add a layer of control and protection to your card

- Turn your card on or off

- Establish transaction controls for dollar amount limits, merchant categories and geographic locations

- Receive alerts when your card is used or exceeds the transaction controls set by you

- Stay informed of potential fraud with alerts on attempted, declined transactions

- Get your account balances in real time

- Download the mobile app — iPhone® | Android™

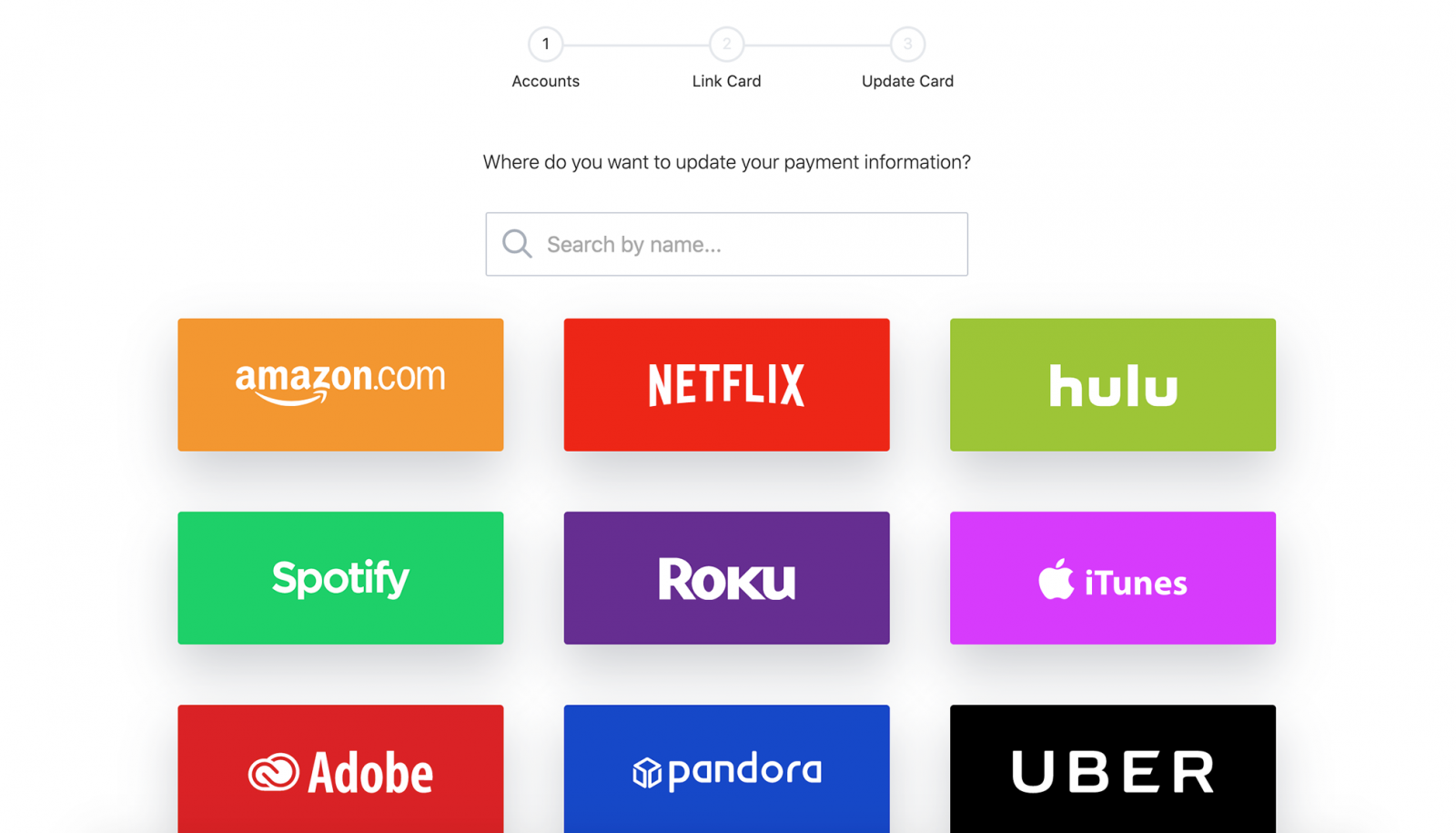

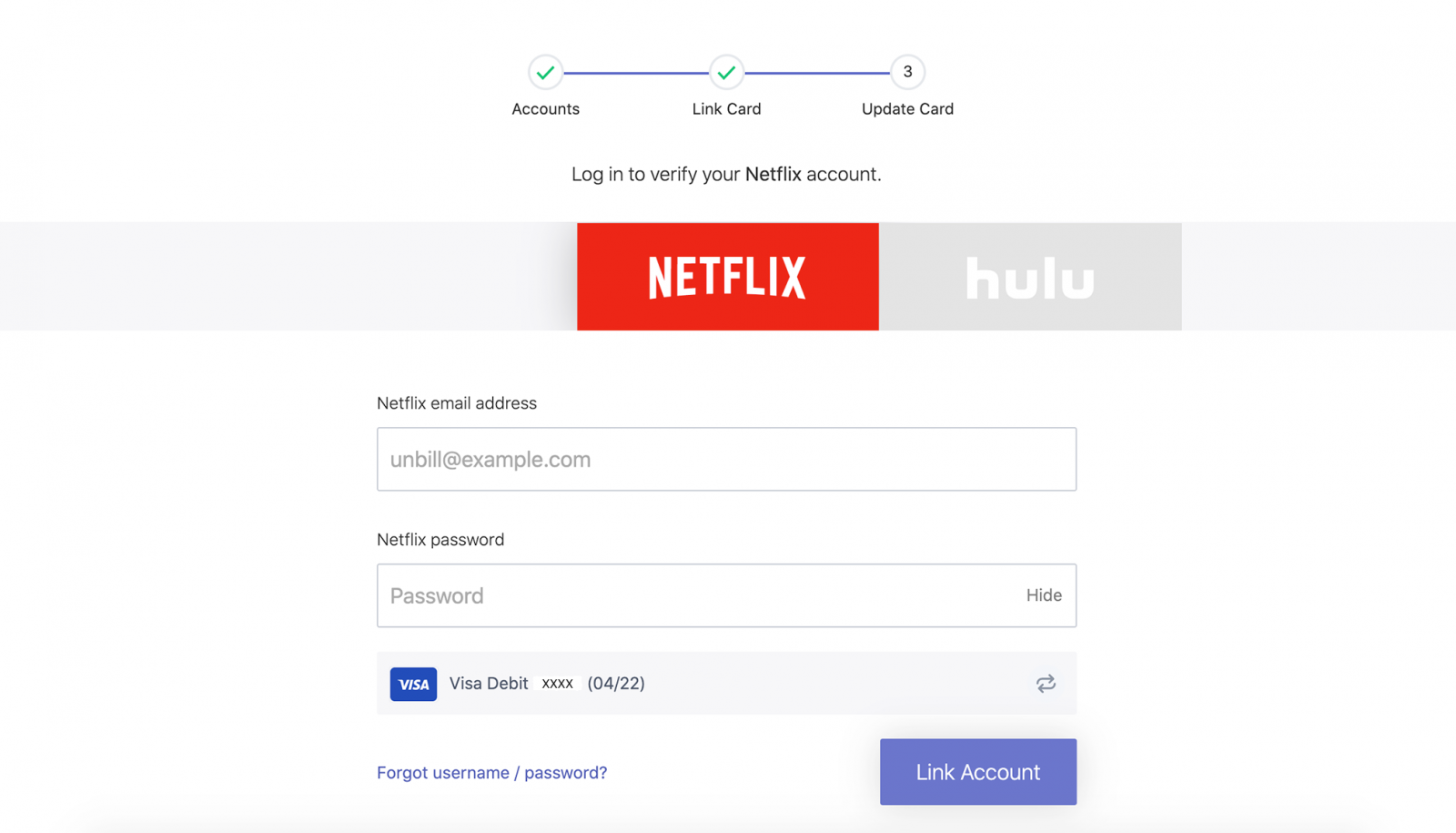

Keep All Your Accounts on the Right Card

A single spot to update your card on file wherever you pay - subscription and streaming services, eCommerce merchants, and more. CardSwap lets you update your debit or credit card information for shopping accounts and favorite digital services, like Netflix, Amazon, and others!

†0% for initial 6 months of purchases and balance transfers.

*Annual Percentage Rate is based on an evaluation of credit and will vary with the market based on the Prime Rate. All loans are subject to an evaluation of each applicant's credit. Membership eligibility required.